Turkey - MDF - Market Analysis, Forecast, Size, Trends and Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingRapid Recovery of the Furniture Industry Restores the Turkish MDF Market from the Pandemic

IndexBox has just published a new report: Turkey - MDF - Market Analysis, Forecast, Size, Trends And Insights'. Here is a summary of the report's key findings.

Following the easing of the quarantine measures in Turkey, the demand for MDF from the furniture and construction industries increased tangibly, recovering from a sharp drop recorded over April - May 2020.

After working remotely during the lockdown, people began to pay more attention to their homes and shop more for furniture and building materials. This led to a revival of the construction and furniture markets. If the country will return to pandemic-free life in 2021, Turkey's real GDP is projected to grow by about 3% per annum in the medium term.

The furniture and construction industries, as the main consumers of MDF, have been hit by the COVID crisis. Restrictive measures during the pandemic led to many enterprises were put on hold, construction projects paused, and sales of furniture were hampered for several months. There was a drop in GDP of approx. -0.5% against 2019, which worsened the slowdown in the Turkish GDP growth recorded over the last three years. The second quarter of 2020 was also marked by a sharp drop in Turkish investment in fixed assets. Against this background, MDF production volumes bottomed out against the last year in April 2020.

The overall recovery of the economy began in the third quarter of 2020. The volumes of investment in fixed assets from this period started to increase, in the fourth quarter of 2020 they exceeded the corresponding indicators of 2019. The recovery of the GDP growth and investments shapes the revival of the wood-based materials market. In May 2020, the MDF production began to grow rapidly and exceeded its pre-crisis level in July 2020.

As the MDF market is predominantly a b2b-market, no dramatic changes are expected in the sales channels. However, online communication becomes increasingly important even in the b2b sales channels, with the use of distant negotiations and electronic document workflow. According to official statistics, MDF production indices rebounded in May 2020, which is a sign of MDF producers adapted their supply chains and sales channels to the “new normality”.

The decrease in furniture production in April 2020 against the increased demand for those products, led to a rise in furniture prices. With the recovery started in the second half of 2020, the growing demand shaped a prolonged increase in prices for wood-based materials, which reflected rising producer prices for furniture. If prices continue rising, it could hamper the demand for furniture as incomes are not expected to grow at that tangible pace. Should this happen, it may put a drag on the growth of the MDF market in the medium term.

Domestic Manufacturing Continues to Force Imports Out of the Market

The volume of MDF imports has reached its peak of approx. 3.5K cubic meters in March 2020 and amounted to $3.5M. Afterward, the MDF imports in Turkey experienced a sharp contraction since the outbreak of the pandemic in April 2020 due to the lockdown. In a broader context, this decrease continued a long-term contraction of imports which had been gradually displaced by domestic manufacturing. Over the whole of 2019, approx. 4.8M cubic meters of MDF were produced in Turkey, while purchases abroad decreased by -64.6% to only 20K cubic meters, falling for the seventh year in a row.

Affected by an intensive growth in domestic production, which will gradually displace imported products from the market, the share of imports decreased from 11% in 2007 to 0.5% in 2019 (IndexBox estimates). Turkey's domestic supply is expected to continue its growth, thereby making the country a less attractive destination for suppliers from abroad. However, the potential for import substitution has been practically exhausted, forcing Turkish producers to look for new growth opportunities.

Furniture Boom in Western Countries May Become a New Driver for the Industry

The pandemic and the related isolation and remote working drive an increase in demand for furniture not only in Turkey but also in other countries. The U.S., for example, experiences a boom of suburban construction and relocation to country houses, which entails an increase in demand for furniture. This trend might be interesting for Turkish manufacturers with regard to searching for the most promising markets to boost exports.

In 2019, the amount of MDF exported from Turkey skyrocketed to 826K cubic meters, growing by 32% on the previous year's figure. Overall, exports enjoyed a strong expansion, fuelled by rising domestic output. In value terms, it amounted to $283M.

Traditionally, the export of MDF from Turkey falls on the countries of the Middle East region. The largest markets for MDF exported from Turkey were Iraq ($57M), Iran ($32M), and Tunisia ($24M), with a combined 40% share of total exports. Increasing exports to countries with rising demand for MDF, e.g., the U.S., where the furniture and construction industries post solid gains over 2020-2021, can be an ambitious goal for Turkish manufacturers. Should this happen, it may become a new driver for the Turkish MDF industry.

This report provides an in-depth analysis of the mdf market in Turkey. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- FCL 1648 - MDF/HDF

Country coverage:

- Turkey

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Trade (exports and imports) in Turkey

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- MARKET STRUCTURE

- TRADE BALANCE

- PER CAPITA CONSUMPTION

- MARKET FORECAST TO 2030

-

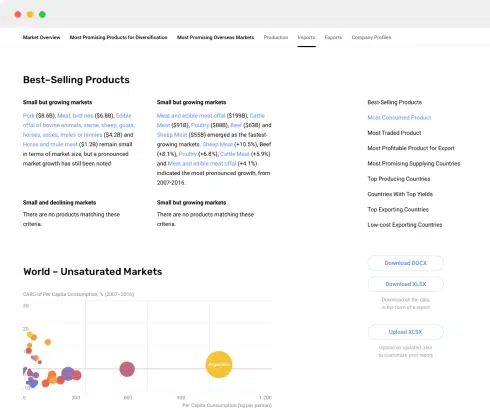

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

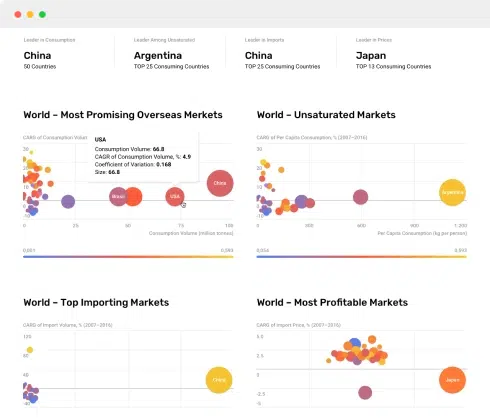

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

8. IMPORTS

The Largest Import Supplying Countries

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Destinations for Exports

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption In 2012-2023

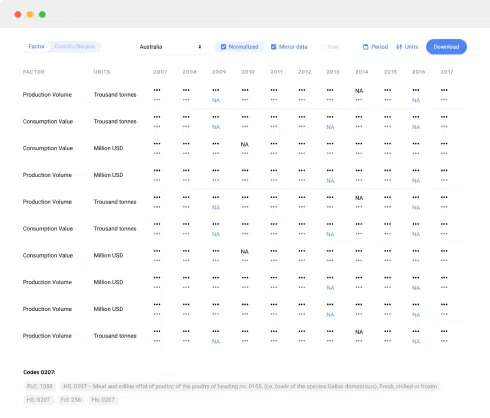

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Market Structure – Domestic Supply vs. Imports, In Physical Terms, 2012-2023

- Market Structure – Domestic Supply vs. Imports, In Value Terms, 2012-2023

- Trade Balance, In Physical Terms, 2012-2023

- Trade Balance, In Value Terms, 2012-2023

- Per Capita Consumption, 2012-2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023