Price for Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda - 2022

Contents:

- Price for Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda (CIF) - 2022

- Price for Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda (FOB) - 2022

- Imports of Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda

- Exports of Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda

Price for Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda (CIF) - 2022

The average import price for nuts, edible; pistachios, fresh or dried, shelleds stood at $2,106 per ton in 2022, waning by -1.5% against the previous year. In general, the import price showed a abrupt decline. The most prominent rate of growth was recorded in 2014 an increase of 50% against the previous year. As a result, import price attained the peak level of $7,100 per ton. From 2015 to 2022, the average import prices failed to regain momentum.

There were significant differences in the average prices amongst the major supplying countries. In 2022, amid the top importers, the country with the highest price was Iran ($14,667 per ton), while the price for the United Arab Emirates ($1,790 per ton) was amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was attained by Iran (+1.7%), while the prices for the other major suppliers experienced a decline.

Price for Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda (FOB) - 2022

In 2021, the average export price for nuts, edible; pistachios, fresh or dried, shelleds amounted to $3,625 per ton, falling by -54.7% against the previous year. Overall, the export price saw a significant contraction. Over the period under review, the average export prices reached the maximum at $55,000 per ton in 2019; however, from 2020 to 2021, the export prices failed to regain momentum.

As there is only one major export destination, the average price level is determined by prices for South Sudan.

From 2016 to 2021, the rate of growth in terms of prices for South Sudan amounted to -54.7% per year.

Imports of Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda

In 2022, after three years of growth, there was significant decline in purchases abroad of nuts, edible; pistachios, fresh or dried, shelleds, when their volume decreased by -87.6% to 189 kg. Over the period under review, imports continue to indicate a deep setback. The most prominent rate of growth was recorded in 2020 with an increase of 307% against the previous year.

In value terms, imports of nuts, edible; pistachios, fresh or dried, shelleds shrank remarkably to $398 in 2022. In general, imports recorded a sharp decline. The pace of growth appeared the most rapid in 2020 with an increase of 163%.

| Import of Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda (USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| United Arab Emirates | 319 | 1,660 | 2,618 | 324 | 0.5% |

| Iran | 444 | 342 | 367 | 44.0 | -53.7% |

| Kenya | 91.0 | 72.0 | 73.0 | 7.0 | -57.5% |

| South Africa | N/A | 97.0 | 104 | N/A | 7.2% |

| Others | N/A | 78.0 | 106 | 23.0 | -45.7% |

| Total | 854 | 2,249 | 3,268 | 398 | -22.5% |

Top Suppliers of Nuts, Edible; Pistachios, Fresh or Dried, Shelled to Uganda in 2022:

- United Arab Emirates (181.0 kg)

- Iran (3.0 kg)

- Kenya (3.0 kg)

Exports of Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda

In 2021, approx. 32 kg of nuts, edible; pistachios, fresh or dried, shelleds were exported from Uganda; increasing by 3,100% against 2020. Over the period under review, exports recorded a significant expansion. As a result, the exports attained the peak and are likely to continue growth in the immediate term.

In value terms, exports of nuts, edible; pistachios, fresh or dried, shelleds surged to $116 in 2021. Overall, exports, however, faced a sharp decrease.

| Export of Nuts, Edible; Pistachios, Fresh or Dried, Shelled in Uganda (USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | CAGR, 2019-2021 | |

| South Sudan | N/A | 8.0 | 116 | 1350.0% | |

| Maldives | 550 | N/A | N/A | 0% | |

| Others | N/A | N/A | N/A | 0% | |

| Total | 550 | 8.0 | 116 | -54.1% | |

Top Export Markets for Nuts, Edible; Pistachios, Fresh or Dried, Shelled from Uganda in 2022:

- South Sudan (32.0 kg)

This report provides an in-depth analysis of the nuts market in Uganda.

This report provides an in-depth analysis of the almond market in Uganda.

This report provides an in-depth analysis of the shelled walnut market in Uganda.

This report provides an in-depth analysis of the shelled hazelnut market in Uganda.

This report provides an in-depth analysis of the walnut market in Uganda.

This report provides an in-depth analysis of the pistachio market in Uganda.

This report provides an in-depth analysis of the kola nut market in Uganda.

This report provides an in-depth analysis of the hazelnut market in Uganda.

This report provides an in-depth analysis of the chestnut market in Uganda.

This report provides an in-depth analysis of the areca nut market in Uganda.

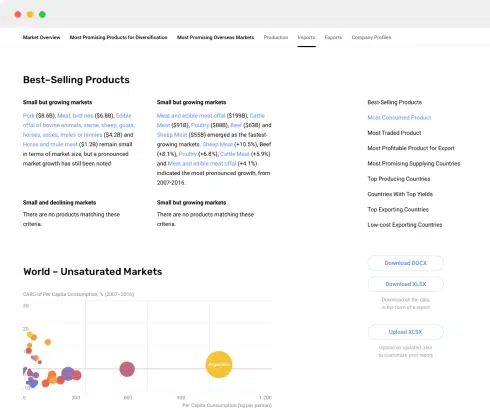

This article explores the top import markets for nuts, including India, Vietnam, China, Germany, Italy, Turkey, the United Arab Emirates, Mexico, Spain, and the United States. These countries showcase a diverse range of preferences in terms of nut varieties, and the statistics provided highlight their significant demand and potential for further growth in the nut market.

Discover the top import markets for nuts and tap into a significant growth opportunity. India, Vietnam, China, Germany, and Italy are among the leading destinations for nut exporters.

The world nut market is expected to reach a value of USD 92.4 billion by 2030, up from USD 66.6 billion in 2022, growing at a compound annual growth rate (CAGR) of 4.2% from 2022 to 2030.

Explore the top import markets for almonds in 2023, including India, China, UAE, Spain, and more. Discover key statistics and trends in the global almond market.

The global almond market revenue amounted to $10.5B in 2018, going up by 6.5% against the previous year. This figure...

From 2007 to 2016, the value of the global almond market showed a stable dynamic trend. However, in 2016, the value of the the global almond market dropped to X billion USD. One of the main reasons for this can be explained by the favourable weather

Global almond consumption amounted to X thousand tons in 2015, going up by +X% against the previous year level.

In 2015, the country with the largest volume of the almond output was the United States (X thousand tons), accounting for X% of global production.

The U.S. seized control of almond market. In 2014, the U.S. exported X thousand tons of almonds totaling X million USD, X% over the previous year. Its primary trading partner was Spain, where it supplied X% of its total almond exports in value

In 2013, the U.S. and Spain were the main global suppliers of almonds with a combined share of X% of global exports. However, the fastest growing suppliers on the global almond market from 2007 to 2013 were Turkey (+X% per year) and China (+X% per